Pocketbook is an easy to use, yet sophisticated budgeting app made by Australians, for Australians. The app launched earlier this year on iOS, and has now made its way to Android.

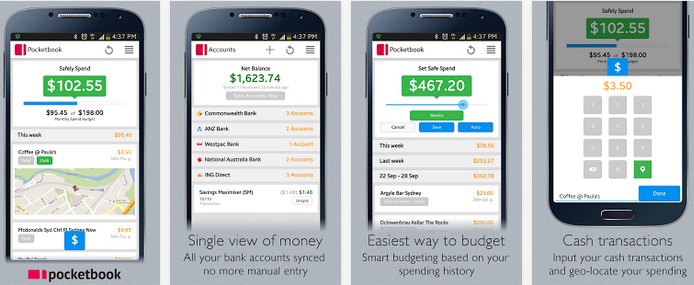

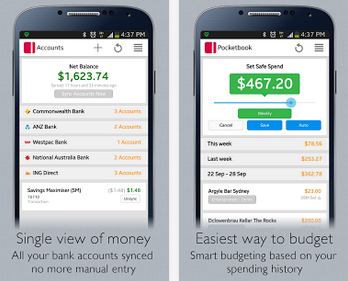

The service aggregates your bank accounts, credit cards, loans and bills. It provides a single view of your spending and automatically syncs all of your bank transactions into a single easy-to-read page.

Pocketbook’s main goal is to simplify your personal finances. It allows you to:

- See your financial transactions in the one place

- Stay on top of your bills

- Minimise bank fees and late payment penalties

- Keep you on track of your budgets and savings goals

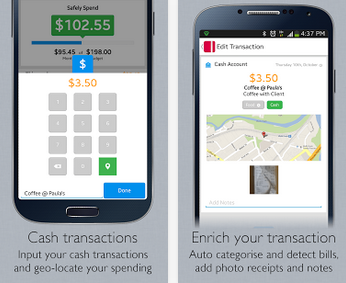

It updates with your spending, and you can manually enter cash transactions – you can also add photos of receipts or warranty information to link with what you’ve bought. Bills that are set automatically with your bank are detected and categorised – Pocketbook will notify you when a bill is coming up and let you know if you have enough cash to cover it.

Pocketbook is compatible with almost all of Australia’s financial institutions, including:

- Commonwealth Bank

- Westpac

- ANZ

- NAB

- St George

- Bankwest

- Citibank

- AMEX

- UBank

- ING Direct

You can also link with an online budget planner to help you achieve your financial goals.

Pocketbook is a free app, and is available now from Google Play.

Do you need a little help with planning your budget? What do you think of Pocketbook? Let us know in the comments!

pocketbook uses cloudflare so good luck with your data and being secure

I’d be concerned from a security point of view

Still doesn’t support MEBank…. 10 months after I first tried it.

Call me paranoid but I don’t like the idea of giving that sort of information (account details) to a third party even more so if it uploads that info to a third party server for the “online budget planner” part

Given the issues these companies have with security like that launcher that came out recently (forget its name right now) that stored all your GPS and apps in plain text on the internet for anyone with a little know how to see

I have similar concerns. I’m comfortable with uploading my transactions (that I’ve exported from the bank), but handing over my credentials so they can do some kind of HTML scraping in the background to download my transactions? I’m not so keen. Surely that’d be a violation of the conditions of use of online banking as well?

I use ANZ Money Manager to do the same thing. No app, web only, but it’s powered by Yodlee which seems to be pretty secure, and the fact that it’s run by ANZ makes me think it’s no less secure than Suncorp or Amex having my log in credentials.

Im a lil skeptical about giving my bank acc details to an app that can do a world of hurt…anyone had experience with this? I think the concerns are plainly obvious. And no doubt a service like this that is free must benefit somehow. Data logging?

Doesn’t have Credit Union Australia. :,(

I use ANZ Money Manager to do the same thing but it doesn’t have a mobile app. How does this compare? Does it have the same features? Is it worth the effort of migrating across?