Investments have always had an air of old-school money to them, they inspire images of old men in wood panelled rooms sipping scotch, smoking cigars and making backroom deals. While that’s nothing really like what goes on, it’s an image that stops a lot of people entering into investing their money, but a new Australian startup called First Step wants to change this image and bring investing to everyone.

The idea is simple, use micro payments from your bank account to slowly build capital in an investment fund. Sound familiar? It’s very much like the service offered by micro-investments platform Acorns. You link your account and the service rounds up to the nearest whole dollar and then extracts a small amount from your account, investing a couple of dollars at a time.

Sounds simple and it’s designed to be. FirstStep says they want you to ‘Take that first step to growing your future by investing your loose change today’.

Starting out

FirstStep is in the startup phase, they’re currently still working to get regulatory requirements such as AFS licensing, registering a Retail Managed Investment Scheme and setting up a PDS, taken care of. But they have some help with that.

The startup is being partly funded by the Sydney University’s startup program Incubate, which offers a 14-week program to startups that involves workshops, a mentoring process and pitching to investors.

Though young, there’s 12-years’ experience in finance and 8-years in web/app development the five member team. The range of experience includes a Chartered Financial Analyst (CFA), a Certified Practising Accountant (CPA), a Diploma in Financial Planning (DFP) and there’s experienced developers on-board who’ve worked on other successful startups such as ServiceLocale.

When it launches – the team is hopeful that it will launch next year – First Step will offer a web based tool, as well as Android an iOS apps. Their mobile developer Tarang, assured me that the Android app will be very much Material Design and distinctly Android in look and feel with a card based design.

Dollars and Cents

The financial side involves investment in a low cost diversified portfolio. What is that?

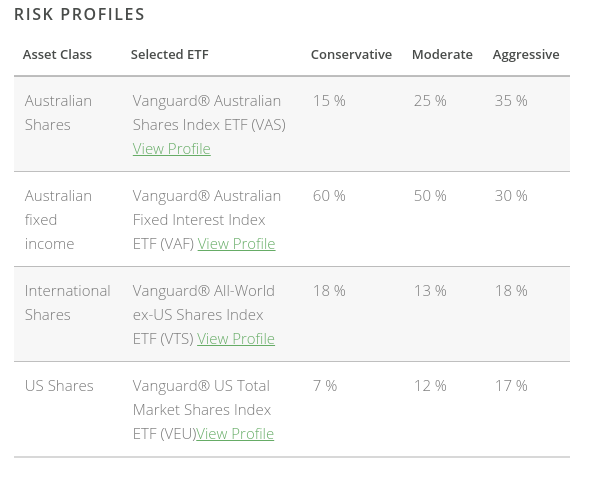

FirstStep will invest your contributions into a combination of four Exchange Traded Funds (ETFs). ETFs are financial instruments that are traded on the stock market. They track broad asset classes. The chosen ETFs we use track the Australian share market, Australian government bonds and the US and world stock markets.

It sounds complicated, but it’s not they assure me and that’s part of FirstSteps long term goal, to educate people in investment. They want to provide information on what is actually going on with your money in the investment across the ETFs.

There’s varying levels of risk involved with investing, that’s not going away, but there will be three levels of investment types – conservative, moderate and aggressive – to attempt to mitigate the risks at least somewhat.

There will be a fee on your investment, but the proposed fee structure of 1% p.a for accounts under $2000 and 0.5% p.a for accounts over $2000 is minimal and cheaper the competition.

Their back-end technology to access the big 4 banks in Australia is protected by ‘bank-grade security’, and they are confident in the security from that aspect. App encryption will be end-to-end using 2048-bit SSL Security and data stored on their systems uses AES-256 encryption. Even the FirstStep team won’t be able to see your bank credentials, it’s all hidden.

Get on board

FirstStep is still getting their product together for launch, but you can show you’re interested by registering your name on their mailing list. To encourage people to register their names, the FirstStep team is offering the first 1,000 users on the app a $5 starting balance.

There’s a lot of promise here, the FirstStep website looks professionally done and the team behind FirstStep are professional, are passionate about their product and speak with great knowledge about the product and what they intend to offer their customers.

There’s competition in the space, but with cheaper fees and an Australian made focus, the FirstStep product is one we’ll be watching with keen enthusiasm.

ATTENTION ATTENTION ATTENTION I am Mrs Rose Cambel Morgan i work with Watts Water Technology in America, i want to use this medium to tell the world about this investment company that have help me to invest my money and now i am benefiting every week of the month just for 2,000 dollars that i invested now i gain 1,000dollars every week, so please i want to introduce the people that really want to invest their money and could not find a reliable company to invest their money to John’s Consulting Firm Ltd. its a reliable company. to get more… Read more »

How can FirstStep compete with the Robinhood app?

Robinhood app allows u to buy/sell stocks with ZERO commission.

Unlimited free trades with no minimum balance.

FirstStep will be DEAD ON ARRIVAL

once Robinhood app comes to Australia.

So, how does Robinhood make money? They make money on interest from customers’ uninvested cash balances.

Stop paying Comsec $65 for every trade!!!

Robin Hood actually sells your order flow to HFT outfits as well as earns off interest/margin. They encourage you to trade, not invest. Their Australian offering currently only works with US shares. There’s also a minimum – the amount the share costs itself. FirstStep has no minimums at all, and we construct a portfolio for you that is meant for the long term so you can build wealth. We don’t encourage trading. We also teach you about shares and so you can use Robin Hood later on. We don’t want you to lose money. We want to teach you to… Read more »

“Build wealth” is phrase commonly used by scams, con-artists and terrible online pop-up advertisements. If you want to be taken seriously, I strongly recommend you never use that phrase again in any of your marketing or communication.

Thanks Benjamin, noted & changed. I’m wary of the phrase too. It’s just this industry is a scammer’s favourite & there’s little left to describe long term investment returns.

Hi everyone. If you have any questions about our startup please go ahead and ask! I love investing and I feel that everyone would love it too.

Hi Tarang, Is the fee over $2000 0.5% or 0.25%, it seems to state both amounts on your site.

Its actually 0.25%. The 0.5% number is slightly dated. We previously had 0.5%, but decided to make it more competitive.

Question 1) Why should I put my money on FirstStep rather than AcornsAU (if I only had to chose one)? Question 2) You said: >>DOES FIRSTSTEP STORE MY BANK LOGIN INFORMATION ON THEIR SERVERS? >>No, we don’t store your bank login details. but then further down your page you said: >>HOW DO YOU PROTECT AND STORE MY BANK LOGIN INFORMATION So the question is, do you store my own bank login or not? Question 3) You said: >> backed up and warehoused on our dedicated servers for audit and compliance purposes. So you have your very own dedicated data centres… Read more »

1) This one is for you to decide. I think if we gave an answer, it would be biased. It was quite disturbing when we heard Acorns was coming to Australia, especially since we had already built our MVP. We love Acorns, but we think they miss alot. We’re sticking to our guns now. I think we make our users better investors and give them more savings. Fundamentally, if we do this, our users will be happier and better off. This will make us happy. 2-4) We take security very seriously. Our team is using this app for our savings… Read more »

Hi Tarang, First off best of luck, I really like this idea and I will definitely be taking part once my invite is processed. My questions are the following: 1. Do you have any guidelines as to how much ‘loose change’ an average person generates for investing? base it on 100k pa if you want a round number. 2. Will I own the shares in etf’s or will you? 3. What are the protections on any funds or shares held in trust by you on my behalf? i.e. some crazy black swan event tanks the universe, is my money ‘FDIC’… Read more »

Hi Will, Thanks for your comment! Just some answers for your questions: 1. Our estimates are that the average Australian uses their bank card about 25 times a month, and with a 50c average loose change amount, this equates to $12.5 per month. 2. Because each user is investing such small amounts, investors’ money will be pooled together in a registered managed investment scheme (MIS) to acquire the underlying ETFs. The user in turn will own units in the MIS according to the amount invested. 3. A custodian will be appointed to hold the underlying assets of the MIS. Its… Read more »

Ok I see, so ther ewill be a different MIS for each risk profile I presume?

Sorry about the late reply on this one. I had to check up. It’s a hard question to answer. It may be either depending on their legal costs. We’re trying to be lean so we can realistically offer the fees which we’re offering.