The last time I used an ATM was so long ago I can’t remember which year it was. All my payments in person are done via Google Pay or other contactless systems, bills paid via direct debit or BPAY and personal payments to friends and family via online banking.

ATM’s will become rarer

According to the Reserve Bank of Australia withdrawals of cash from Australian ATM’s have declined sharply. ATM withdrawals in April were down 30 percent from the month before and over 40 percent lower than twelve months earlier.

ATM withdrawals have been on a trend downward decline for a number of years. But the decline seen in March and April was a substantial downward shift in the level of withdrawals.

This no doubt reflects both a decrease in spending overall as people stayed home as well as a shift to other payment mechanisms – contactless cards and online shopping in particular. It seems likely that a large part of this will become a permanent change in behaviour.

Say goodbye to cheques very soon

Similarly the use of cheques has been on a steep decline for the past 20 years, both in terms of number of cheques written and the value.

In April, the value of cheque payments was more than 40 per cent lower than twelve months earlier, compared with annual rates of decline of around 20 per cent in previous months.

The level of cheque usage has now fallen to such low levels that there is an active discussion about the future of the system. Cheques have always been a costly way for companies to accept payment – the last time RBA examined their cost in 2014, cheques were around six times more costly than card payments in terms of resource costs per transaction.

One option that is actively being considered by the banking and payment transactions industry is closure of the cheque system. With electronic conveyancing increasingly the norm, a major use of financial institution cheques is being phased out. And for bill payments, where cheques are still sometimes used, there are many alternatives.

There has been a concern that there are some people for which there is no suitable alternative to payment using a cheque. They may not have reliable access to the internet to undertake online banking, for example, or may not have a debit or credit card.

The changes associated with COVID-19 provide an opportunity to reassess this. With social distancing affecting some branch services and the ability of people to get to branches, there has been a push by the banks to get people signed up to internet banking. Payment options such as BPAY and instant NPP will therefore be available to a wider range of people.

Banks have got permission to mail out debit cards to customers, typically passbook holders who did not have them, providing the option of online and in-person payments by card. It seems likely that these changes, which have happened much more quickly than they might have otherwise, will further reduce the use of cheques and demonstrate to people that there are alternative and more efficient ways of making payments

Cash will have few friends

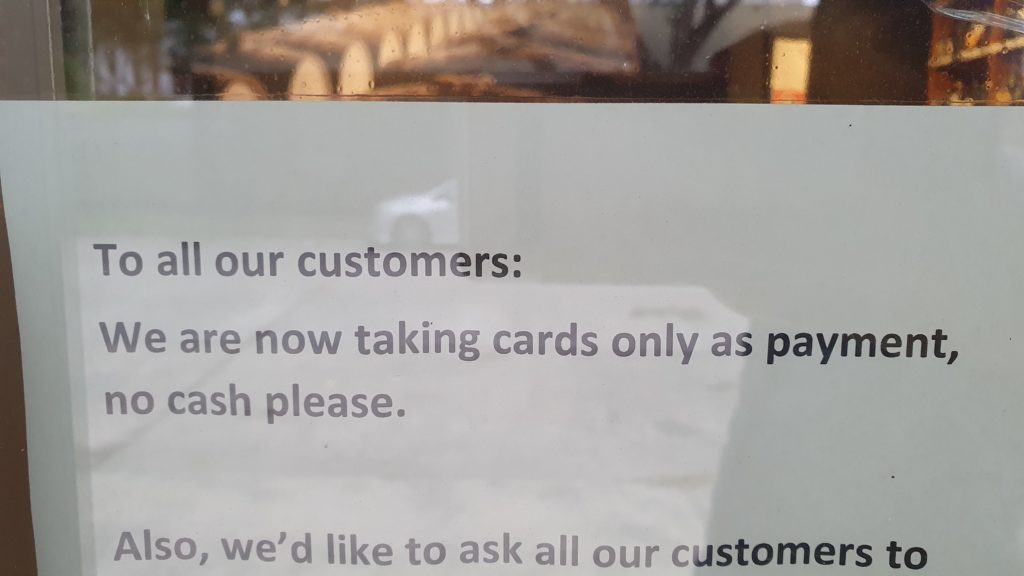

During the COVID-19 pandemic both merchants and consumers appear to have been keen to reduce their use of cash. Many merchants made it clear through signage that they preferred contactless card payment, even for low-value payments.

Some even went as far as to indicate that they would not accept cash. Maybe partly in response to this, and their own concerns about hygiene, many people reduced their use of cash in stores. In addition, there was a significant shift to online shopping, where cash is simply not a payment option.

Payment providers have facilitated these moves. The transaction limit below which a PIN is not required for a contactless card payment was (temporarily) raised from $100 to $200 to further reduce the need to touch terminals. Banks promoted mobile payments, which, because of biometric identification, often do not require PINs even for large purchases. And banks also obtained dispensation to mail out debit cards to a large number of their customers that did not already have them.

All of these changes are likely to result in permanent shifts in behaviour as some people maintain the new ways of doing things. People who have recently obtained a debit card for the first time now have the ability to use a card at the point of sale as well as make online purchases.

The increased use of online shopping, either through necessity or preference during the ‘stay at home’ period, seems likely to be a permanent shift. In response, many retailers have increased their online offerings and may even find that they can reduce their physical presence.

There have been some calls for the ‘no PIN’ limit to be maintained at the current higher level, which would make point-of-sale card payments even easier. And mobile payments have probably received a permanent increase in their level of acceptance.

TLDR: Cash is going to be a lot rarer across the board, cheques will most likely be phased out within a few years, ATM’s will become even harder to find, while contactless and online banking payments are going to increase even faster.

Which of these Payment methods have you used in 2020?

How has Coronavirus impacted the way you pay for products and services in store and online? Which services have you used this year? What is your favourite payment method?

Good article.

BTW if you’re going to insert a TL;DR it needs to be near the beginning. When we come across it at the end of the article it’s too late as we’ve read the whole thing already!

I should change banks! Newcastle Permanent didn’t up their no-PIN limit, and they still haven’t enabled Google Pay. Their mortgage rates are very competitive, however, and that’s ultimately more important to me.

I work in a business where instant purchase means money has to be in my hand or in the bank as cleared funds. That is at the moment cash or credit card payment. Most transfers are still delayed by hours up to days. That will have to change for cash to go. We also have to remember that cashless is still the privilege some people can’t use. Where does a homeless person have there billing address. Is a homeless person going to have to carry a square payment reader so I can drop the guy/gal 5 dollars. Don’t let privilege… Read more »

Haven’t used a debit/credit card in over a year. If a store doesnt accept cash, I go elsewhere. When I need to buy something on Amazon, I just gift cards.

I hardly used cash before Covid-19. Since working from home since March and hardly leaving my local area, I can’t remember the last time I used cash. The sooner I can convince my wife to use Google Pay on her phone the better.

I am a user of Google Pay myself and have been for sometime and if a phone doesn’t have NFC I won’t buy it. However, I still use cash at markets, fetes and similar locations because these small venders don’t have EFTPOS. Additionally, these stores that fail to take cash operate in complete violation of federal legislation which states they must accept ALL legal tender which means cash and card. It’s very easy for the register operators to wear disposable latex gloves while handling cash.

Sorry you’re wrong

“Australian banknotes and coins do not necessarily have to be used in transactions and refusal to accept payment in legal tender banknotes and coins is not unlawful”

https://banknotes.rba.gov.au/legal/legal-tender/

The biggest change for me, from no longer using cash for purchases, is the slow growing collection of all the loose change that I’d accumulate over the course of a year, has come to a halt. That would average about $120 to $150 at the end of a year. This year, the collection had yet to reach $40 before things came to a halt, in early March.

By your calculations, it had yet to hit $40, so let’s estimate $30 at the end of Q1. You’d still be on track for $120 by the end of Q4.