This isn’t something I thought I’d be writing about on Ausdroid, but here I am looking at a trading and investment platform. The company behind the software, Tiger Brokers invited us to take a look at their software and an early look at their TigerGPT tool which can offer great information on trends in trading and — the usual financial warnings apply — advice on what to buy and sell.

As a complete novice to the investing space, I thought this was as good a place as any to start. I got the chance to have a briefing with a few of the team from Tiger Brokers about the investment space and TigerGPT.

For background, the company was founded in 2014 and has become one of the largest online brokerage firms globally supporting over 9 million users; Australia being one of its key markets. Through the implementation and development of its platform Tiger Trade, the company has leveraged the online world to provide instant access to securities, share indexes, educational opportunities and other critical information to users, with that stepping up again with access to TigerGPT.

When I spoke with the Tiger Brokers’ team, the discussion outlined a number of drivers for the company moving forward. Ultimately, the foundation of the platform is the recognition and aim to sooth pain points for investors, whether they’re experienced or brand new to the game.

As someone who has considered investing in the past, I know that finding information can be difficult to find when you don’t know what to look for or where to find it.

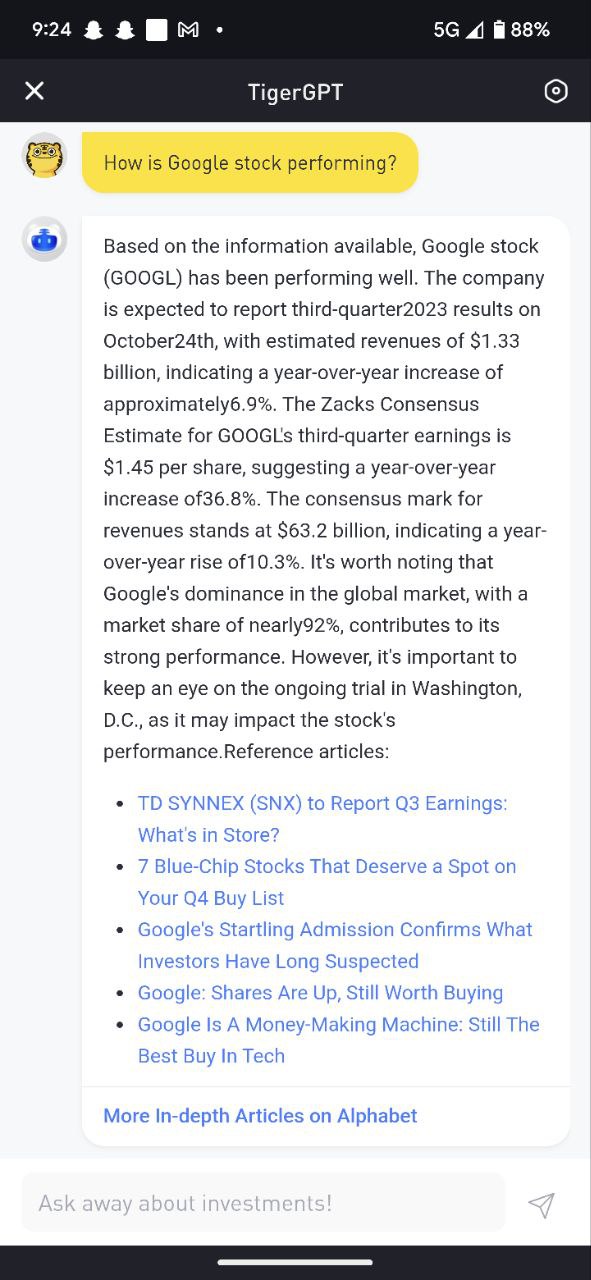

Tiger Brokers are looking to make trading simple, safe and accessible through the introduction of features to ensure that investors learn the ins, outs and dangers of investing. This is where they believe that the market will adapt to AI and a GPT client to assist users in analysis of market trends, ensuring up to date information is provided to users, with constant information and market data being injected into the system.

This gives users access to key details and access to the latest information on the market and — in my experience — very cautious “advice” on what may, or may not be wise investments. Even the ability to either auto-invest, or to manually deal with your investment portfolio. If you’re cautious about your options, then auto-invest may be a really good option for you with the time to learn about the market and investing.

My experience: A steep learning curve

After spending time with the Tiger Brokers team on a virtual meeting, and spending time in the app the takeaway I have is — keep in mind, I’m not an expert investor — that this is about bringing a full picture to users. Giving them the opportunity to make smart, educated decisions with balanced and honest information provided by experts, analysed by AI.

As a rank novice to investing, I found some of the provided information frustratingly non-committal, but I understand why. After looking into some of the queries I used TigerGPT for independently about what could be safe investments, the responses were stable and slow return options.

It would be nice if some of the advice given was a bit more definitive, but that’s risky. The reality is that investing money into a market like shares, is volatile and presents a financial risk; so offering categorical advice is dangerous for Tiger Brokers or any other brokerage firm.

What they’re offering is instant access to analysed information, that then equates to an educated decision you need to make. If you choose to let Tiger Brokers and their systems handle the investing on your behalf, that’s a very viable option.

If you’re looking to learn a bit about investing and aren’t too wary of AI providing you that opportunity, I’d definitely suggest giving Tiger Brokers a look. Personally, I’m not ready to start investing; but I’ve learned so much about the market just by engaging with this app for a few weeks and tracking some high profile stocks.