If you’re a freelancer, you’ll understand that sometimes while handling your business, you won’t have sufficient cash. That’s why you need to invest in your venture and go the extra mile to achieve success. Nevertheless, not all freelancers realize they can reduce expenses by getting rebates from their taxes.

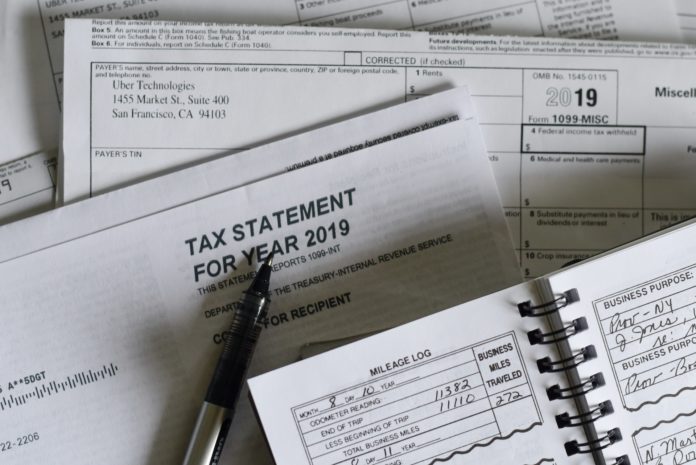

If you use a vehicle for your freelance business, you can track the miles you’ve traveled to get tax rebates. The two key methods are the actual expense method and standard mileage rates.

Several freelancers prefer to go with standard mileage rates because of their relative ease and convenience. This method prompts freelancers to record all the miles they’ve driven with a vehicle and multiply it with the cost given by the IRS. Using standard mileage rates can take up to several hours. That’s why you need to get a mileage tracker app such as Driversnote from Google Play Store. Mileage apps save time and costs.

This article will show the benefits of using a mileage tracking app as a freelancer.

Advantages of Using a Mileage Tracker as a Freelancer

-

Saving Money

Most freelancers habitually stick to their monthly budgets, so they don’t get caught off guard financially. Using an app to track your vehicle mileage can save you a lot of money. This makes it a crucial tool to possess. Running a freelance business is not easy with the boom-and-bust cycles of your finances.

IRS rule outlines that 57.5 cents can be deducted for each mile traveled. If you travel for work a lot, this number could be high.

-

Adapting to Changes

The world as we know it is constantly experiencing rapid changes. As a freelancer, you could experience a time when clients would prefer physical meetings and, thus, do a lot of traveling.

If you experience a change like this, you’ll want to ensure that you lessen the costs associated with constant travel. Recording the distance you cover with a mileage tracking app will help you estimate how much you can save annually.

-

Expediting Work

Tracking mileage manually can take a lot of your time. As a freelancer, you understand that this time can be better spent on job tasks that can bring in money.

Since mileage trackers on mobile devices record all your travel details, calculations are performed automatically. This is crucial because inaccurate submissions to the IRS can get you in trouble.

Conclusion

Several freelancers don’t realize they can get tax rebates if they track the miles covered with their vehicles. The advantages of using a mileage tracking app include adapting to changes, expediting work, and cutting down on expenses.