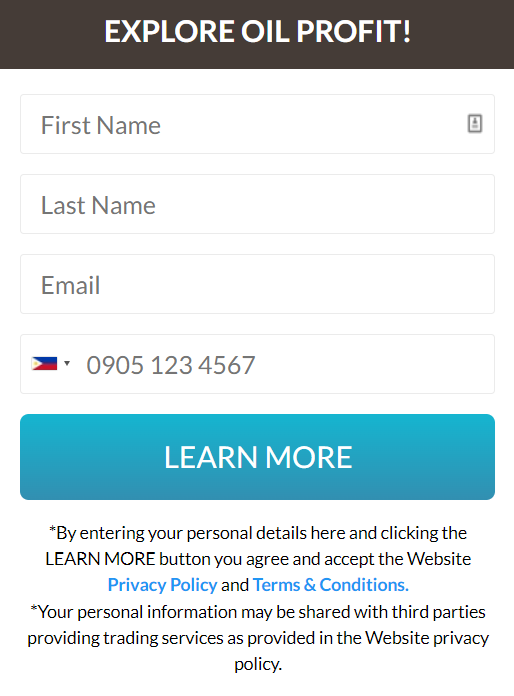

There are up to ten different suppliers for each oil product, and a variety of supply chain go-betweens add value by processing materials, packaging, and delivering products. The current supply chain workflow follows a linear path from exploration through production and consumption. Click this image below if you are interested in oil trading.

To improve this workflow, blockchain can enable improved transactional security through computer automation, enhance over-the-counter transactions with self-executing smart contracts and enable new business models such as tokenization to monetize supply chains’ assets.

Blockchain can provide feedback on production:

Blockchain will provide feedback on product distribution and create transparency into the cost structure within these processes to maintain market exclusivity while driving efficiencies between producers, traders, and consumers. Many blockchain projects are creating a new market for cheaper transactions to minimize market exclusivity and maximize profit.

For example, in the oil and gas industry, there are two primary categories of crude oil: light crude (such as Brent) and heavy crude (such as West Texas Intermediate). A blockchain platform for energy transactions has been created to combat this high pricing differential. This single platform will connect consuming companies directly with suppliers based on location and product type, allowing for transaction reconciliation at a lower cost than current supply chains.

For example, blockchain can inform consumers that every step of a product’s supply chain is verified as sustainable, organic, or certified by relevant authorities without any centralized authority controlling the information. Consumers can also be sure that their money will end up where it should. For example, when a consumer buys a tokenized barrel of oil on a blockchain platform, and the technology records that transaction on the blockchain, it ensures that the revenue from that barrel ends up in its rightful place.

Adoption of blockchain can disrupt the oil industry:

The rapid adoption of new technologies typically leads to uncertainty and the need for clarity around regulation, creating an environment unsuitable for further development. The technology has already been used for over two years in the financial sector, so many regulatory bodies, including the CFTC, SEC, FCA, and others regulatory bodies, have already started exploring blockchain technology as an additional tool for capital market supervision.

As a result of this exploration, there are already clear rules on how to deal with this emerging technology which will help reduce some of the uncertainty around blockchain use in today’s oil supply chain environment.

Blockchain can automate the oil industry supply chain:

One of the principal drivers for blockchain adoption in the supply chain is to improve efficiency. Data exchange between several parties requires intermediaries and manual steps to record and process that information. With blockchain technology, all data can be automatically stored and processed, which will reduce the number of intermediaries involved in the process. Furthermore, the information is stored and processed automatically and can be accessed directly by all parties involved in the transaction or operation.

Blockchain can simplify the oil supply chain:

Most of today’s supply chains are very complex, with many parties involved where data integrity and exchange of information are required. Moreover, the centralized nature of existing business models produces even more complex due to legal, regulatory, and regulatory environments.

Blockchain technology can simplify the overall business model for oil supply chains dramatically. In addition, implementing blockchain technology will significantly reduce the costs and time needed to get companies up and running with an implementation. Several organizations have already embarked on pilot projects to provide proof of concept for blockchain technology in the oil supply chain.

The Oil and Gas industry is one of the very few that have successfully gotten the ‘buy-in’ from both government and private sector. In recent years, we have seen significant developments in this sector as Blockchain technology has been deployed to ensure compliance and audit trails between oil companies and their vendors.

A key objective of this initiative was to develop smart contracts which would allow suppliers to automatically provide auditable proof of delivery, quality, and performance data as soon as the new oil is produced. In another instance, the Petroleum Development Oman (PDO) recently announced that it would deploy blockchain across all its 40 active upstream fields by Q3 2022. It will be a first in the petroleum industry, enabling PDO to increase its operational efficiency and safety while reducing costs associated with field maintenance scheduling and engineering change orders (ECOs).