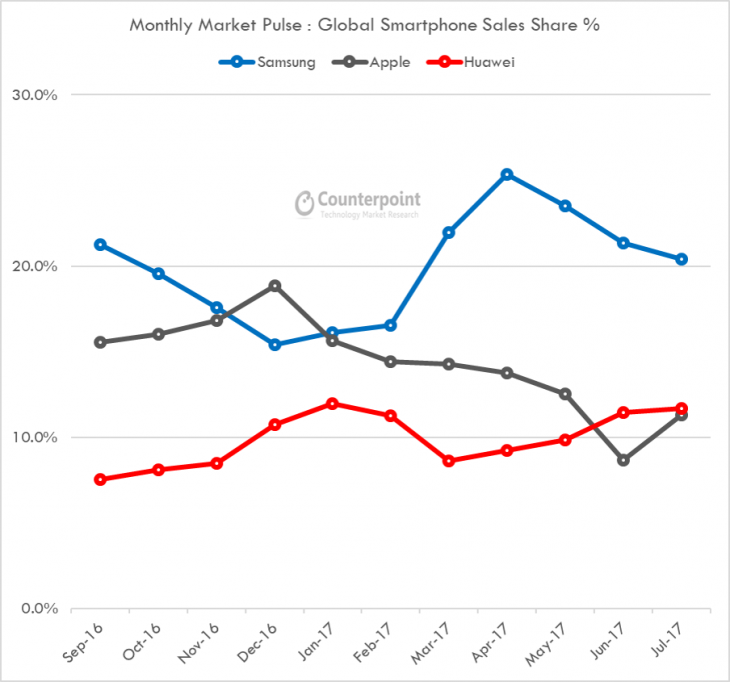

Chinese brands are restricting the growth of Samsung and Apple according to the latest research from Counterpoint’s Market Pulse for July 2017.

This echoes recent data from IDC about mobile phone sales in Australia:

IDC said that OPPO continued to establish and grow themselves in Australia with 5% market share. The launch of two new devices, A57 and A77 following on from the success of the F1s has fuelled solid growth.

OPPO continues to expand their Australian retail partners. It’s latest move adds Telstra as a retailer of the A57, which is expected to fuel further growth moving forward.

Huawei’s penetration of the Australian market continues with 4% market share on the back of the flagship P10 series launch as well as significant growth in the prepaid segment through its Y series devices available from Telecom operators.

Counterpoint’s Research Director Peter Richardson noted that Huawei has surpassed Apple in global smartphone sales consistently for June and July. He said that

“This is a significant milestone for Huawei, the largest Chinese smartphone brand with a growing global presence. It speaks volumes for this primarily network infrastructure vendor on how far it has grown in the consumer mobile handset space in the last three to four years.”

Counterpoint’s Associate Director, Tarun Pathak also pointed out that “the growth of Chinese brands is an important trend which no player in the mobile ecosystem can ignore. Chinese brands with their dominant position in key markets such as China, Europe, Asia and Latin America have restricted the growth prospects for leading global brands such as Samsung and Apple”.

“Chinese brands are growing swiftly thanks not only to smartphone design, manufacturing capability and rich feature sets, but also by out-smarting and out-spending rivals in sales channels, go-to-market and marketing promotion strategies.”

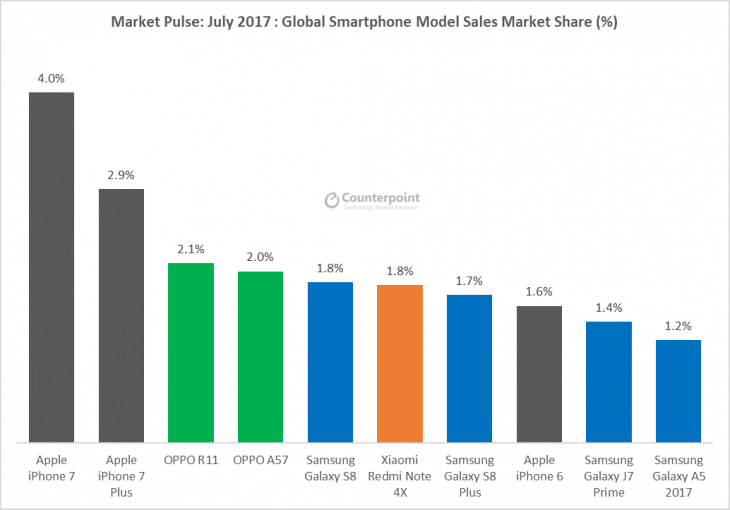

Commenting on the best-selling models in the month of July, Senior Analyst, Pavel Naiya highlighted, OPPO has been one of the fastest growing brands globally thanks to the popularity of models including the flagship OPPO R11 and the mid-tier OPPO A57 that captured third and fourth spots respectively behind the leader Apple. These were followed by Samsung’s flagship Galaxy S8, Xiaomi Redmi Note 4X and Samsung Galaxy S8+.

Naiya added that “while Huawei climbed to be the world’s second largest brand overall, it is surprising to see none of its models breaking into the top ten rankings. This is due to a multiple SKU portfolio that currently lacks a true hero device. While having a diverse portfolio allows Huawei to fight on multiple fronts, it does little to build overall brand recognition; something Huawei badly needs if it is continue to gain share. While Huawei has trimmed its portfolio, it likely needs to further streamline its product range like Oppo and Xiaomi have done – putting more muscle behind fewer products.”

> Chinese brands are restricting the growth of Samsung and Apple

Overpriced phones, user hostile system specs, and price gouging are restricting growth of samsung and apple.

If they reined in their profit margins, they’d would find more takers – or even just listened to what people were after (cough, headphone jack, IR blaster, bigger battery, Qi charging, microSD, etc).

No phone is worth $1000, and there are plenty of chinese manufacturers that realise that the big boys have priced themselves out of the market.

Yep that about sums up the situation. Sure there will always still be sheep attracted to the latest shiny object that will pay whatever it takes to get it. I think a lot of the public is now at a point where they are looking for better value option and are willing to try out a cheaper Chinese option. I know I am one of these people having very recently bought a Xiaomi Mi5s. I had been very much looking to get another Motorola but found all of the recent announcements to be uninteresting and overpriced and found that the… Read more »