We’ve all had those phone calls that you know immediately are a scam. They range widely but the aim of the game is to either get money directly or personally identifiable information from you for identities theft. Recently though, these calls are getting smarter in terms of how they are presented and are relevant to current times.

Even well-educated people in positions of authority in major organisations have been caught out. So it pays to stay alert — and sceptical — when you receive a call from a number you don’t know seeking any information.

Some of the common themes of scam calls are:

- Identifying as being from the “Australian border force” telling you your name has been used to ship illicit substances and to avoid arrest, you should follow the instructions

- Claims of a tax debt that you can somehow pay off with iTunes vouchers

- Calls from banking or phone providers with either: An issue with your account or offering discount

- Flubot – Claiming you have a voicemail and to retrieve it you simply need to install an app

- Text messages claiming to be from a courier company who’ve tried to deliver a package

- Email scams far too plentiful to list

What are the warning signs?

When it comes to scam calls, there’s plenty of warning signs to look out for. The starting point is they probably don’t know your name, or anything about you other than your number: They’re phishing!

Some of the calls you may receive are quite comical by nature such as one I received recently telling me that there was unusual activity on my Commonwealth Bank account. I told them that was unusual as I don’t bank with Commonwealth and hung up. But had I been a CBA customer, this could have been a catch point and cause for concern to me – as soon as they cause doubt, you’re inclined to explore the call further. It’s these chance moments that make scam calls work.

Never volunteer information about yourself, accounts or personal history.

If you’re receiving a call about one of your accounts (banking, insurance etc), they should essentially know everything about you. They know what bank you’re with, what insurance company you use and will generally identify themselves clearly and what the call is about immediately.

If you’re getting asked about your accounts, with zero information given to you: Red flag!

An example that brought just how good scam calls are getting to my attention, is one a friend of mine received.

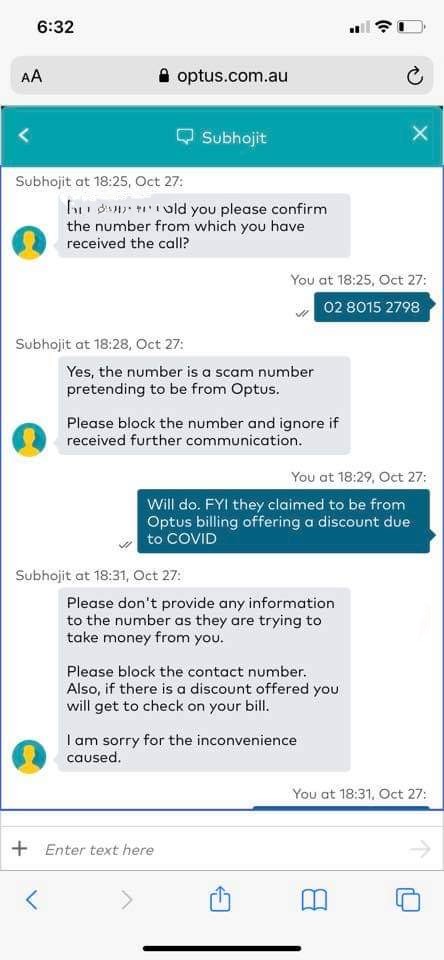

Identifying as from Optus — by chance, she is with Optus — offering discount due to COVID-19 impacts. Knowing the likelihood of having such a call, the loud call center and foreign accent, she dismissed them and hung up. But then doubt crept in: “What if they really were from Optus?”.

So she did a very smart thing and contacted Optus support via an official contact pathway, their site. It was here she was told that she was correct to hang up, it was not a call from Optus, but a scam looking for account information.

Which got me thinking, is this the best pathway to verifying if calls are legitimate?

The short answer is yes! After talking to staff or representatives from mobile carriers, insurance and even superannuation – All of them stated it was a valid pathway to request bits be left on your file and to call the company line back immediately from a number based on official websites.

Protecting yourself from scams and identify theft

There are some simple steps you can take to protect yourself in our connected world. We’ve outlined a few above:

- Be on guard against calls from unknown numbers.

- Never volunteer personal information.

- If in doubt, call/contact the company back through their official channels.

But one final step you can make is too slow down any progress they can make, by using good password practices online. The main two steps are to turn on two factor authentication for everything you can, and use unique passwords for everything.

This means that if one password is compromised, they don’t get immediate access to your email, banking and government (My Gov, Medicare and Tax) accounts where more information or money can be taken from you.

With our entire lives online these days, it’s increasingly important to look after yourself and your data online. Be smart, be vigilant and protective of your personal information to give yourself the best chance of staying safe online.

Buy the Pixel 6 and get Call Screen along with all the other anti-spam features inside the Phone app.