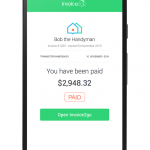

Popular Australian invoicing software Invoice2Go has today announced a new function coming to their product, introducing the ability to receive debit and credit card payments.

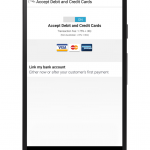

The ability to charge customers credit and debit cards comes to Invoice2Go through integration of Stripe Connect payments, which will allow transactions without having businesses to invest in EFTPOS infrastructure. The feature has gone live in the US already where users have found the integration sped up payments by up to 8 days.

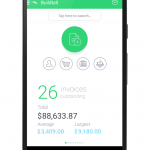

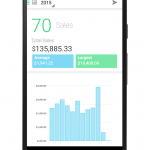

The integration of debit and credit card payments into Invoice2Go allows for a more complete product, allowing businesses to present a more professional look, as well as track their time, improve cash flow and untangle themselves from paperwork in one simple application.

Chris Strode, founder and Chief Product Officer of Invoice2go said of the new feature:

What’s unique about the feature is that it brings the entire billing process into one app, a game-changer for every Australian business owner who spends hours manually invoicing, collecting payment, and reconciling their accounts.

The ability to accept credit and debit card payments, without setup and maintenance costs, gives small businesses access to technology that was previously reserved for larger companies. Australian small business owners can now meet the expectations of their customers in today’s digital age, and improve their cash flow by getting paid faster.

Invoice2Go offers businesses three levels of service, starting at just $49 per year and scaling up as businesses require more functionality. The Stripe Connect payment function will cost an additional amount on top, with Stripe deducting a fee per transaction. The cost of transaction is different in each country, however Invoice2Go has provided a handy chart:

|

Country |

All debit and credit cards |

International cards (including American Express) |

|

United States |

2.9% + 30¢ |

2.9% + 30¢ (same as domestic) |

|

Canada |

2.9% + 30¢ |

2.9% + 30¢ (same as domestic) |

|

United Kingdom |

1.4% + 20p |

2.9% + 20p |

|

Australia |

1.75% + 30¢ |

2.9% + 30¢ |

|

Ireland |

1.4% + 25¢ |

2.9% + 30¢ |

If you’re looking into adding the ability to charge your customers without an EFTPOS machine, this could be a good way to go. There’s always the option of using other infrastructure such as Square’s reader dongle, or PayPals solution, but it’s always worth checking which has cheaper fees per transaction. You can check out the Invoice2Go app on Google Play, or check out their website for more information.