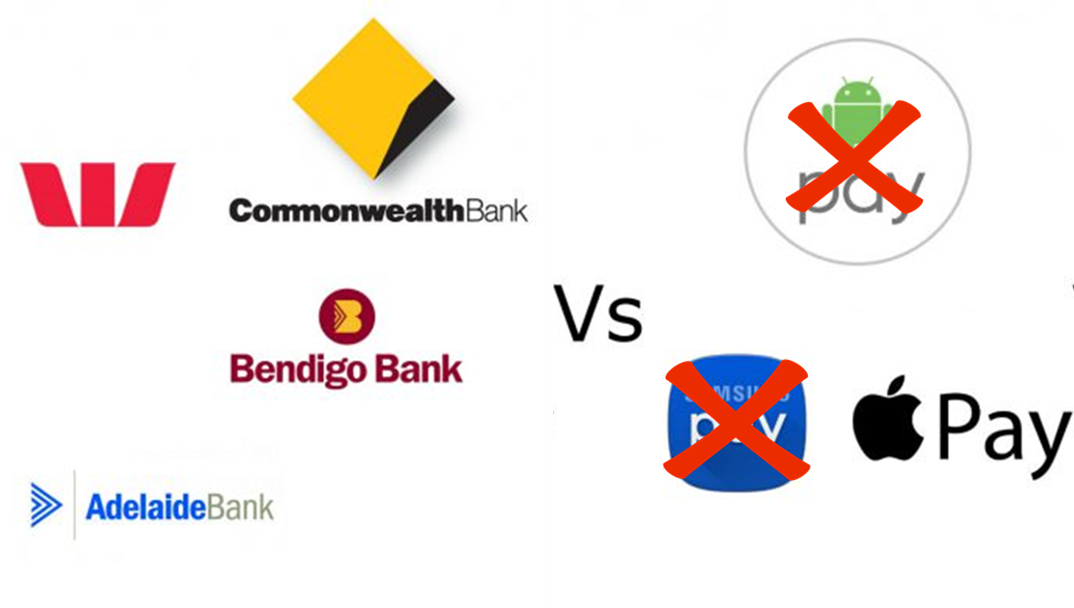

We originally reported on how some of Australia’s largest banking institutions, including CBA, Westpac, and Bendigo Bank, had sought permission from the Australian Competition & Consumer Commission (ACCC) to enter into a collective negotiation and boycott of “all mobile payment/wallet services”. Subsequent to that the ACCC provided a temporary judgment refusing the application pending further submissions.

Since then many submissions have been received including one from Google Australia. It seems that following these submissions and testimonies from many interested parties, the collective of banks have refined their position. As of their latest filing on the 7th of October, the group is now solely seeking permission to enter into collective negotiations and boycott against Apple and Apple Pay, “applicants propose to collectively negotiate with Apple in respect of Apple Pay”, and “applicants do not intend to collectively negotiate with any other third party wallet provider”

From an Android perspective, we could leave this here and say, see Android is open it’s all good. However, two items of interest remain, firstly, now that the consortium of banks has narrowed their dispute to just Apple will they ipso facto now commence negotiations to support Android Pay and Samsung Pay? Secondly what about the larger question of the application to negotiate with Apple?

Android is open; will the banks embrace it for mobile payments now?

On the first matter, yes Android is open, and yes there are both APIs Australia banks can use to build mobile payment apps for Android and there are a number of such apps in Australia. So if this major component of the bank’s concerns does not exist on Android then, if their intentions are as they state, we should see these institutions start to work with Google Australia to implement the consumer option for Android pay into their product offerings any day now.

Failing to do this may well serve as evidence for Apple that the bank’s motives are not so pure as to foster consumer choice and innovation in the Australian mobile payments space, and could, in fact, have more to do with their own desires for platform domination. We sincerely hope these institutions sit to the table with Google and/ or Samsung to look at offering their customers those choices.

Should the banks collectively negotiate with Apple?

As for the larger debate around whether the commission should grant the banks the permission to collectively bargain with Apple, that is indeed a larger and trickier issue, and one which I am not qualified to answer. However, Apple has shown it’s relentless ability to use it’s sheer platform size and customer numbers as a heavy negotiation tool. Many still say that the music industry has never recovered from the Apple-ification of music purchasing.

It’s genuinely hard to consider siding with either the record industry (not recording artists the industry) or the banking sector, however, Apple may well be one of the most dominant business forces in the world, and certainly seem to be using their user base and dominance to pivot into other ‘profit centres’. Technically Apple does not have a monopoly, we often quote that Android is 80% of the smartphone market, however, it could be argued that Apple has the monopoly on smartphone profits.

Sure the Android platform dominates the percentages but the iOS ecosystem collects a dispositionally large amount of the actual revenue and overall profits in the smart things world. It’s hard to reach a final conclusion in this debate, and lucky we have the ACCC commissioners and their advisors to weigh up these arguments and the legality of the request.

Rather than a conclusion, I pose these questions to you; do you want Apple to dictate the terms in which they enter the Australian financial market? Do you think Apple has the best interests of the Australian people or our financial sector at heart? Who will better protect your rights in the end?

Feel free to weigh in below, this is a complex issue with complex legal and social issues surrounding it.

The Aussie banks and their overpaid IT staff who can’t even get some simple websites or apps to work properly need to worry about how to do the simples things right and leave the serious tech to the tech companies. I know some of the top IT exec at some of the biggest banks in Aus (as I went to uni with them). They were some of the poorest performing students (some on the cusp of expulsion for constantly failing programming subjects) and yet they now find themselves in these top IT roles at the banks. I truly ask myself… Read more »

If you really knew these people you would know the banks have outsourced their IT to India. Staff here are mostly on 457 visas from the outsourced company and are paid bugger all. The projects that I have worked on have shown that a majority of their staff are young and completely incompetent (for the reasons stated above). It is sad because it makes people think that Indians are useless when they are not, what is happening they are getting the cheapest they can get to fill a position. You do come across some truly brilliant people from these outsourced… Read more »

Neither!

To be blunt, this is just the bulk of Aussie banks throwing a tanty over something they cant control, ANZ didnt seem to have any problems supporting both Android pay and Apple pay!

Personally I hope the ACCC tells the rest of the banks to “go stick their head in a pig”.

I absolutely agree with you. This is not about fairness. I think the way apple throws their power around isn’t the best but the banks are upset that they are not making crap tons of money off this.

or to be more precise, the Banks dont want to share any of their obscene levels of card transaction revenue with Apple or Google.

I was initially concerned that the big banks were purposely holding back Android Pay development in a way to make this targeted negotiation with Apple seem a more holistic debate…. and i was deeply concerned that this negotiation would go no where for a long time. I really do hope that the big banks just release the android pay support for their apps I don’t really see Apple budging on their stance with allowing access to the NFC features… but they may settle with lowering their ‘% take’ of each transaction which was the big banks complaint from the start.… Read more »

Apple –never– advertised general NFC features of its phones.

The longer it takes to negotiate a deal with Apple the longer Android Pay has to establish it’s presence. I am a Westpac customer who now has a Bendigo Bank account. I doubt many people will change banks just for phone payments, except for a few impatient early adopters. My Android Pay has worked at every pay wave machine I have tried.

” Do you think Apple has the best interests of the Australian people or our financial sector at heart?” Neither. Apple has, as they always have had, Apple’s best interests at heart. They may gloss it up in other terms for marketing purposes, but Apple is a business that wants to secure its profit margins and they are, normally, very successful in doing so. That isn’t a criticism of Apple either, more of a compliment really, as most companies would kill for profitability of Apple’s proportions. Similarly, the banks have their own profits to look after. Neither party involved in… Read more »

I tend to agree neither side of this war is looking out for our best interests. However, as much as it pains me to say i’d probably have to side with our banks before i took Apple’s side of this argument. While our Banks certainly rake in astronomically high profits, they have absolutely no obligation to hand over a cut of every transaction that their customers make to Apple. In reality most of our big banks wont lose much if they dont implement Apple pay, as more and more are beginning to support Android Pay, and many already have their… Read more »

I believe I (roughly) understand the issue and I also think the Banks have a reasonable argument… which is why I didn’t ever understand why Android Pay was on the list.

Regardless, It’s delayed Bank of Melbourne (Westpac) too long for me to want to stay with them and I’m moving all my banking elsewhere. Banks have never been good with transparency.

I would expect all the above banks to swiftly push out Android compatible apps. Not only does this show good faith, it puts pressure on apple. The reality of the problem is that apple see this as a profit generator, and the banks want that profit for themselves. Apple won’t want to give in, given the precedent that will set internationally, and the banks don’t want to see ‘their’ money going to an interloper. Upshot is that probably nothing will happen till the idea of payment via physical device is supplanted by the next big thing. Seriously, the difference between… Read more »