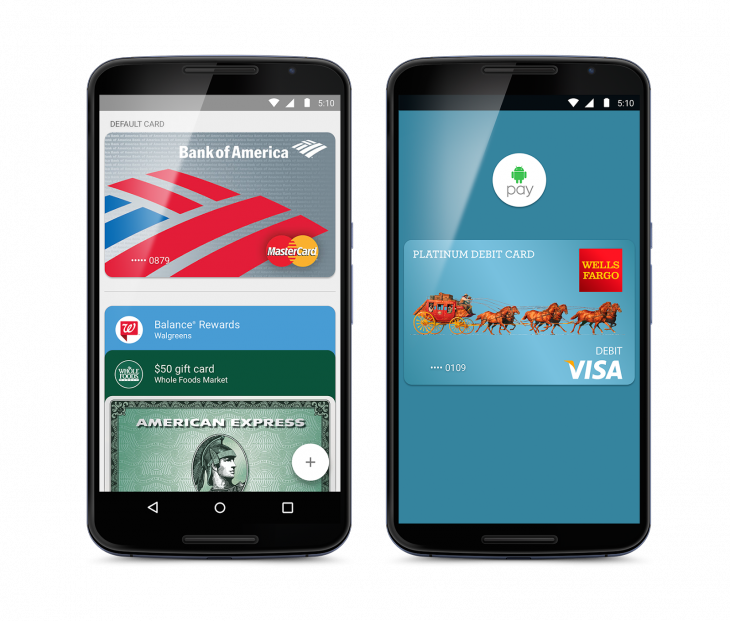

Google’s second attempt at mobile payments, called Android Pay was announced at Google I/O back in May. The service has gone live in the US overnight and according to Google it’s expected to expand to more countries soon.

According to the announcement post, Android Pay is now live at more than one million locations, including Toys’R’Us/Babies’R’Us, Subway and their major departments stores such as Macy’s and Bloomingdales, but essentially the message is that anywhere Tap & Pay is supported – so will Android Pay be.

The reason that Android Pay is now working almost everywhere is the adoption of a standardised token system for payments which is supported by the top four major payment networks: American Express, Discover, MasterCard and Visa. It’s this standardised token arrangement for payments that is Australia (and the rest of the world’s) best hope for expansion of the service. Google’s previous system Google Wallet, used a proprietary system that wasn’t easily rolled out internationally, but with a standardised system we should see it elsewhere and Google agrees stating in a Google+ post :

The list of US banks and credit unions on-board with Android Pay is a fairly comprehensive one, with more being added soon. Google is apparently working to bring more on-board as the rollout progresses.

When I spoke to Google at I/O in May, they saw the value in expanding to markets like Australia where Tap & Pay is almost the default method for using Credit Cards. That Australian’s are massive users of Tap & Pay isn’t just anecdotal with MasterCard’s chief emerging payments officer, Ed McLaughlin telling Forbes in a recent interview:

In Australia, around 60% to 70% of our transactions under $100 are already contactless because consumers like the speed and convenience.

This market is expected to grow in 2015, with Westpac Group predicting that contactless payment transactions will surge for up to $3 billion in Australia this year based on the current uptake of the technology.

The rollout of Android Pay is beginning in the US right now with an updated Google Wallet app being sent to compatible handsets now. Compatible of course meaning those handsets with an NFC chip on-board and running Android 4.4 and above. The brief hands-on I had with Android Pay showed that it was a great system and just plain worked and I can’t wait to see it rolled out here.

Got Android Pay set up, will try at 7-Eleven tomorrow…anyone else tried it in Australia yet?

How did you get it working in Australia? I get a ‘Google Play Services Error’.

Tried it at 7-Eleven and maccas…the transaction starts but is declined, don’t get any transaction details in the app either. This was using the virtual card brought over from wallet.

I’ve been using the CBA app for a few months now. I definitely love heading out to get lunch without needing to carry my whole wallet with me. Some machines though don’t like NFC on phones. ANZ, I’m looking at you. Update already! :p

I don’t see what all the fuss is about either. What difference is it if I tap my phone or tap my credit card? I don’t see how it’s more convenient to tap the phone, and at the end of the day it’s coming off the same card linked to the Google Account as the one sitting in my wallet.

If it functions as apple pay does its nice to get a push notification every time you use your card for anything. Thats all I want it for.. its unlikely ill use my phone to tap and pay.

Don’t have to carry all your cards so thinner wallet/purse. Without the cards, your wallet/purse doesn’t get skimmed for nfc credit card numbers by teched up thieves whilst still in your wallet/purse in your pocket/handbag. Your accounts are now pin protected in your phone. Two factor authentication now becomes feasible for the super security conscious (although we don’t quite have that available to us yet). I expect Google will want to (re)evolve the tech where the receipt is sent back via nfc to the phone from the nfc payment terminal. In my opinion it is similar to the leap from… Read more »

Trouble is if the machines don’t accept contactless payment or specific machines don’t respond well to NFC (See rbfx4x’s comment above) then unless you carry the cash you’ll be in trouble.

CBA offers Cardless Cash up to $200, carry some cash for incidentals, use Tap & Pay for everything else. Simple.

That’s fine if there is a nearby ATM but still nowhere near as flexible as an actual card that can be swiped/inserted if Tap & Pay doesn’t work.

I generally always use cardless cash from CBA ATMs. You know how often it is going to happen to me when I haven’t planned around it? Not much. If it bothers you, maybe you carry what, one debit only card for cash emergencies? The best bit is what I see long term. Once people only carry a wallet for loyalty cards, they will stop carrying loyalty cards. This will force people to support loyalty card barcodes (or less optimally apps). This could mean you no longer need to carry anything except ID…the simplicity of it all…all in your phone…I wonder… Read more »

If you carry a card around for emergencies, it sort of defeats the purpose of Android Pay in the first place doesn’t it? 🙂

expecting from google is like day dreaming….i’m happy that i use my wife Comm bank account on both of our phones 🙂

I wouldn’t be too devastated if Android Pay didn’t come to Australia.

Commbank Tap and Pay works well anywhere with contactless terminals (which is pretty much everywhere). Still can’t figure out why the Americans are so excited over having contactless payments at “selected retailers”…

Have to remember that they didn’t have wide spread tap-to-pay terminals like we have here! That is rolling out there now. Its sort of why I thought Apple Pay wouldn’t be as exciting to Australian’s as it is to Americans.

A lot of Americans just use cash. I was really surprised to see the lack of use of technology in most of the Us outside certain areas like NY, LA etc. Remember the tipping which is cash in hand and not declared to the IRS

Cash and cheques!

One day we’ll have this magnificent feature. Until then, I will have to keep carrying my wallet everywhere 🙁

Switch banks to CommBank – I’ve been tapping away with my phone everywhere for yonks. CommBank’s mobile app would have to be the best in Australia.

Yeah they really need to add credit card as a payment method and it would be perfect.

This. I don’t use the feature because it is only debit. I would use it everywhere otherwise….

NAB Has NFC tap to pay. So Happy.