Now, I should preface this by saying I’ve had an Up account for over a year, but that doesn’t really matter much – signing up for an Up bank account takes minutes, and your account (and virtual debit card) are enabled within those minutes, so you too can switch your banking in less than an hour.

Why would I want to switch?

I’ve long thought that the Big 4 banks are the dinosaurs of our society – they’re slow to catch up with modern technology, and when they do, they often don’t get it right. ANZ’s mobile app is great, but there’s so many things it doesn’t let you do – manage your PayID, manage upcoming payments, etc. Plus, the Voice ID thing is horribly annoying – this morning I tried to transfer some money between my own accounts, and I couldn’t because Voice ID couldn’t identify me in a noisy environment. How ridiculous.

It was the last straw, and I decided to move everything to Up. If you’d like to sign up to up with a $10 bonus to get you started, click here and use Ausdroid’s referral code. We don’t get paid, but you do, so you’ve got nothing to lose!

By contrast to ANZ, Up offers everything I want – I can enable/disable PayID in app, I can see and manage future transfers, I can easily create new savings buckets and move money around instantly. I get notifications when money hits my account, when payments are processed, and – when I give my card to others to go buy coffee / food / etc – I can see when my card is used.

There’s also no stupid (and superfluous) security protocols either. Identify with a PIN or a fingerprint, and you can move your money around. Sorry ANZ, it was the straw that broke the camels back!

So, how easy is it to switch? Very!

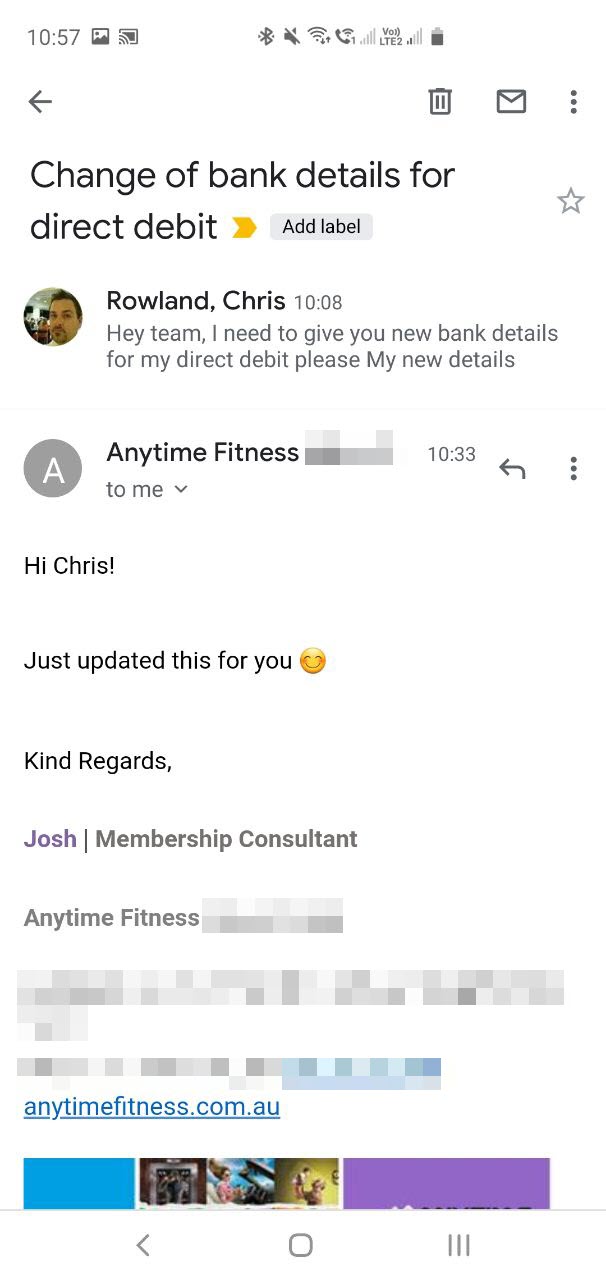

First up, Up copies your account details to your clipboard so you can email them around easily – so advising my gym (my only direct debit) and my employer (for salary / expenses) of new bank details is super easy! Better yet, the gym responded within 20 minutes.

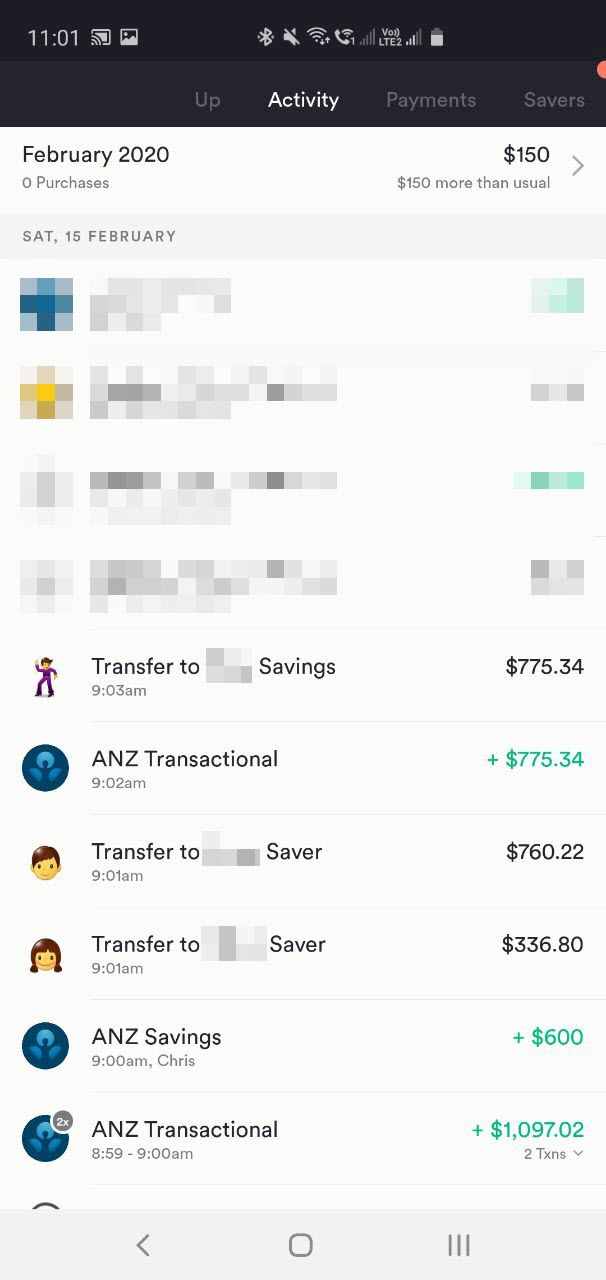

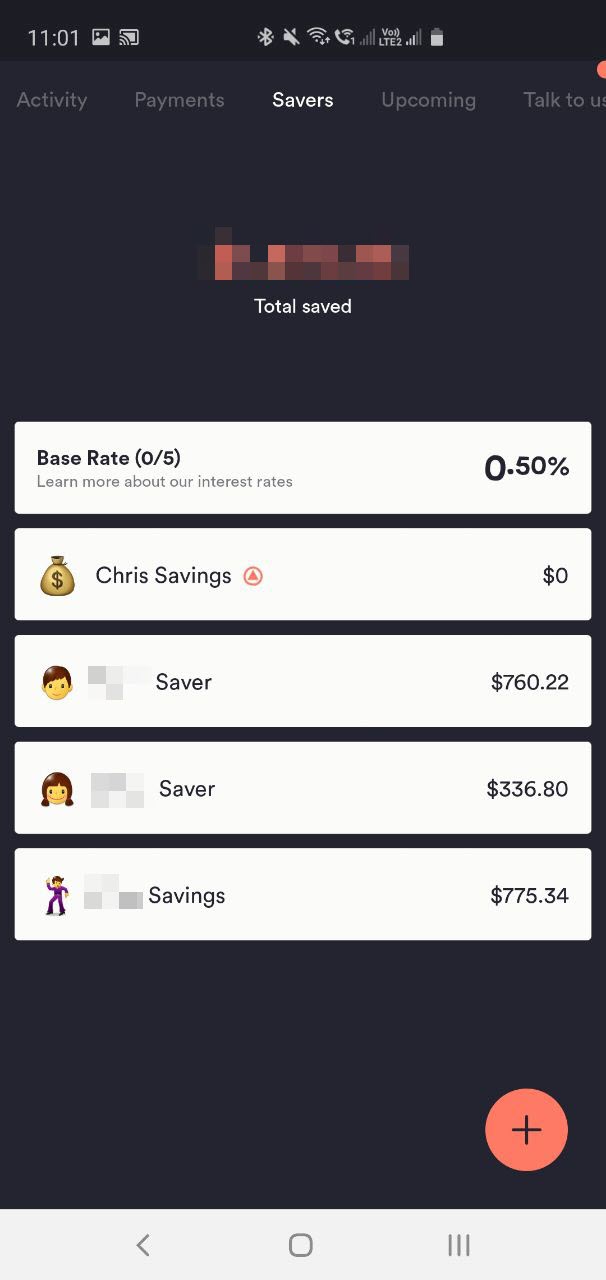

Moving your money from your existing accounts is easy too. In my case, I’ve got my transaction account, my savings, and a savings account for each of the kids. Because Up creates an automatic Pay ID for your account (you can add your own, but the auto one is easy), transferring my money from ANZ to Up took just a couple of minutes – just use the auto Pay ID, tap in the account balance to transfer the lot, and it appeared in Up in seconds:

Once that was done, the only thing left was to set up my automatic transfers from my salary. This took a little longer, as I had to do them one at a time with my ANZ future transactions open on my laptop, so I could type them into the Up app.

This was a slight pain point, because (a) ANZ’s mobile app doesn’t let you view future transactions, so I had to use a laptop, and (b) Up doesn’t have a web app, so I couldn’t copy from one browser window to another. However, a browser-based Up app is coming so that you can use things other than your phone … we just have to wait.

Setting up the future transactions wasn’t too hard though, and now I can see the upcoming list in-app, too.

Obviously, your transfer from a Big 4 bank to a digital-first bank like Up might take longer, especially if you have a lot of direct debits to identify and move. I’ve been quite strong in my resolve to avoid having any direct debits (I’d rather schedule payments than have someone else ‘take’ them), so for me this isn’t really an issue.

The only other downside to Up (pardon the pun) is they have no credit products yet, so if you need/have a credit card, you’ll have to leave that with whatever bank you use. In my case, I’ll keep ANZ’s low rate (and fee free) credit card for now, even though I rarely use it.

Have you recently moved your banking from a Big 4 bank to a digital bank? What was your experience?

No updates for 10 days. looks like the droid is no more. Could there just be a website problem ?

Yep, had to do a ctrl-refresh on the page for new content to appear. I wonder if others are seeing the same problem.

Might just be a caching issue on the client side; there’s new content every day 🙂 We have – as do most content websites – caching strategies in place to reduce the load on our server, but these shouldn’t interrupt your experience.

As a former IT and Strategy employee of one of the big4, I also can add my weight(which is large!) behind the move away from mainstream banking. However, I would advise caution in your choice. I am not saying that there is a risk, but carefully identify the features that are important to you and look at which one fits your needs best. In the last 12 months or so, I have opened accounts with4 banks, UP, Bank Australia, UBank and 86400. I was curious about UP when it launched and I thought it was basic, but new features came… Read more »

The trouble with the Big 4 banks is that their executives receive mega-wages that must be supported by reducing the interest rates in their customer’s savings accounts.

Risk doesn’t come into it, now that the government guarantees neobank accounts up to $250,000, so put your money where the highest interest is – Xinja, 86,400 and Up. Some of the neobanks already offer Osko fast transfers, Google Pay / Apple Pay and other modern features.

Anyone would be mad to keep money with the Big 4 banks, with low or no interest paid.

But anyone thinking about the neobanks should compare them all: Up Bank, Xinja Bank, 86,400 bank, Volt Bank. Compare the interest rates between them. And the neobanks are government guaranteed up to $250,000.

Referral link didn’t work for me on my Android tablet. It redirected me to the Up app in the Google play store but I got no $10 credit. The app asks if you have an invite code as part of the signup.

Referral link works better on desktop than mobile devices, but if you use the referral code ‘AUSDROID’ it should work.

Off topic, but could not find any other way of contacting someone one this site?

Since you changed your website I can not scroll down past the first 10 stories or go to a second page of stories? So I am missing out on a lot of you stories and news.

Hi Peter, at the bottom of the main feed there’s arrows to navigate to older content. Let me know if you can’t find it? Also the contact page is here and we read all our mails: https://ausdroid.net/contact/

I’ve signed up to almost all the neo banks and each experience has been great. However, Up has been the best so far and I’m stoked with their customer service as well.

Up does not allow any cash deposit not even at Post Office, not that I need to do that all the time, but when you need it you really appreciate it can be done. In Up’s case cannot be done. I agree it has some really nice treats. You apparently cannot speak to anyone, the times I have attempted to speak to someone was always met with a voice mail, even at random times of the week and time and despite leaving a voice mail, no one calls you back despite it had been days. Chats you did with them… Read more »

I can’t remember the last time I made a cash deposit at a bank. I just don’t need it.

The whole reason the digital neobanks can offer a vastly better interest rate than the old Big 4 is because the neobanks aren’t shuffling paper, such as banknotes or cheques, or metal tokens (coins are Roman technology.)

None of these things has ever been an issue for me. However, if I need to deposit cash, I can do it via other accounts, or I can give it to a mate and they can transfer me the cash. Not ideal – there needs to be a way to deposit a cheque or cash for those rare occasions where it’s needed – but it works.

Plus some banks (I think Commbank does it) will let you deposit cash and they’ll deposit it to any BSB / Account number.

Cash is a ridiculous thing in this day and age. Why would anyone use it, unless they want to avoid paying tax.

We’ve got Google Pay, Apple Pay, Fitbit/Samsung/Garmin pay. You don’t even need a wallet, let alone cash.

No joint accounts is the killer plus no web-based internet banking (yet, it’s coming apparently). Also ING give you fee free withdrawals at any ATM worldwide (they rebate the fee) which is incredibly useful when travelling.

Some of the neobanks are offering MasterCard or Visa debit cards, with no international currency fees, which you can use when travelling overseas. Shop around. Compare.

Up definitely offers this – Mastercard Debit card, no fees for international transactions (unless you withdraw cash at an ATM and the ATM operator charges withdraw fees).

Waiting for the browser based app before I move. Have been tempted for a long while but held back when my phone broke.