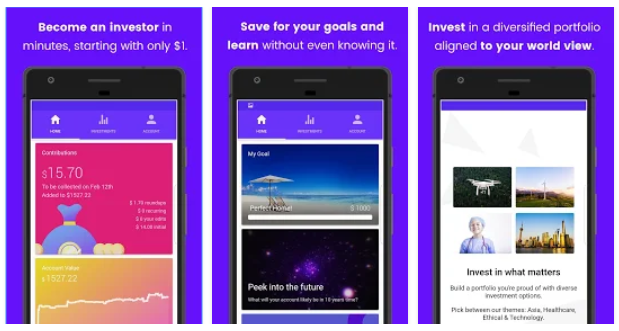

We first covered Australian investment startup FirstStep back in 2015, and since then, they’ve come along in leaps and bounds. Their aim is simple – to help young people (and every one else) to automatically invest small, regular amounts to grow their investment portfolio.

This concept might sound familiar to you – American firm Acorns offers similar – but as an Australian company, FirstStep is one we’re definitely interested in. First introduced in 2015 through the University of Sydney’s accelerator program, and the Melbourne Accelerator Program in 2017, the platform now has iOS and Android apps available.

The platform gives investors two choices – regular, fixed investments by direct debit, or alternatively, it can scan your bank transactions and round up each one to the nearest dollar, and invest that amount instead. Here’s how the rounding up process works:

So each day FirstStep Investments will look at your bank account, to see if there are any new purchases that are less than a whole dollar. Say you bought a coffee for $4.50. They then do some simple math, rounding up to the next whole dollar – in this case to $5.00 – and they withdraw that difference – $0.50 – moving the cash to your FirstStep account.

You might be wondering how they secure your bank account information, given that they need access to your account to “scrape” these figures to put together your weekly investment. There’s a comprehensive FAQ on their website, but here’s the salient points:

- Australian Executor Trustees, a professional custodian, independent from FirstStep holds your investments. A ET Executor Trustees Limited (AET) is one of Australia’s largest and oldest licensed trustee companies. AET has been providing custody and trustee services for over 130 years, having been established in 1880. AET is a member of the IOOF Holdings Limited (“IOOF”) Group, a leading provider of wealth management products and services in Australia. IOOF is an ASX200 listed company.

- By providing your bank login details, it allows FirstStep Investments to categorise your spending so you can monitor your spending habits and find investment opportunities. This information is encrypted and is not readable or viewable by FirstStep – it’s simply used to import your spending activity.

- All our data is stored using AES-256 encryption and 2048-bit SSL Security. Security is a major priority for us, that is why we have spent a lot of our capital on penetration testing, facilitated by an overseas third party who specialises in testing military grade security measures.

- When you use FirstStep, your bank details are encrypted and are not visible or readable by anyone, not even by us.

I’m going to give FirstStep a try, and see what I come up with over a period of time. I’m quite excited to give this Australian firm a go, and see where it ends up. Of course, I can’t recommend enough that you make your own financial decisions, take your own advice, and do your own research.

This isn’t a promotional piece, and we’re not being paid to tell you about FirstStep. They shot an email to our media releases inbox and having read into it, I’ve decided to try it out.

If you’re going to do the same, let us know what you think.

Tried to sign up but won’t authenticate my bank account. Eh obviously still have teething issues.

I don’t use linkedin, twitter, facebook. I don’t like having apps installed on my phone that can possible compromise me. I can’t create a login just using an email address, so I am out.

No such issue using acorn for the last 12 month, guess I will have to stay there.

Thanks for the heads-up on First Step. I have been with Acorns for about a month or so and I was surprised at how much I already had in my account. Quite a neat idea. Anyway I like the idea of doing this with an Australian entity so have closed my Acorns account and had plan to jumped over to First Steps, however they only work apparently with the Big Four banks so that move has been short lived.

Oh not being able to get past the PDS does not help either.

Just scroll to the bottom of the PDS to continue. There is even a nice skip button provided in case you are feeling daring.

On the tablet scrolling to the bottom of the PDS does not light up the continue button hence my comment.