Small, or individual merchants looking for a cheap way to process credit card payments can today start using Square Reader, who have launched here in Australia.

Square Reader is a global payments tech firm based in California, who provide both the hardware and software to allow anyone to accept Visa, Mastercard, AMEX or even debit card payments by swiping the card through their mobile dongle. The Square Reader is quite small plugging into your headphone jack allowing you to swipe credit or debit cards, and pairs with the Square Reader app which is available free on Google Play (and the app store for iOS) then processes the payment.

The Square Reader is available to purchase from the Square Reader website for $19, but will soon be available from Bunning and Officeworks (and some fruit related retail store?). Square recently announced a contactless reader in the US and while contactless payments are on the roadmap for Australia, they seem to be concentrating on setting up Square here first, saying :

We see payment innovation as more than just at the immediate point of transaction – it’s everything from the simplicity of getting set up and accepting payments within minutes, the depth of analytics, transaction speed, the connectivity to enhanced services, fast deposits directly into your bank account, the ability to have one integrated view of business, and the simplicity of beautiful hardware and software design.

The Square Reader that we’ve launched today is designed for mobility and minimum form factor—perfect for mobile businesses like tradespeople, personal trainers, market sellers, food trucks, micro businesses, startups and many more.

So, at this stage there’s no details to share on when we’ll see the contactless payments module release.

Square isn’t just a credit card reader, it’s a whole solution, so that means software. The Square app is available on Google Play with Australian transactional banking services company Cuscal working behind the scenes. Cuscal has previously helped successfully add NFC payments to the banking apps for both the CUA and People’s Choice Credit Union, so they have a strong history in the banking industry in Australia.

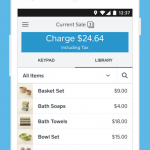

Transactions process through Square are processed with a 1.9% transaction fee taken out, something that Square is quite proud of. Square’s Australian Country Manager Ben Pfisterer said

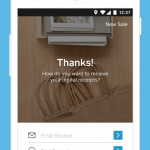

In Australia, the rate paid by businesses to accept card payments can be incredibly confusing and vary greatly, depending on the size of your business, card type and length of your contract, and almost always involves hidden fees. Sellers using Square Reader pay only 1.9% per card transaction, and this is the first time Australia is seeing one low, single rate for a powerful ecosystem of tools—from integrated card payments to a powerful point of sale, analytics and reporting tools, inventory management, online invoices and digital receipts.

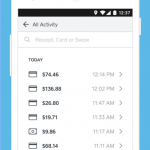

Once a payment is processed, funds are transferred to any Australian bank account. The time between charging and payment is listed as ‘fast’, but exact time frames may depend on your banks back end processing. The screenshots in their app though do list 1-2 days for funds transfer.

Jack Dorsey, CEO and Co-Founder of Square, said of the Australian launch:

With the launch of Square Reader in Australia, we’re empowering local sellers with the tools they need to start, run, and grow their businesses. Our launch in Australia is an important step for our company and an exciting moment for a market so committed to innovation and an entrepreneurial small business community.

If you’re interested in getting started on Square, head over to the Square Australia website and sign-up to get started.

I picked up one of these when I was in states recently; but I didn’t expect to get any real use out of it in Australia given we’ve phased out signing in favour of PINs and chip verification. I’m a bit surprised to see Square launch into such a market where their product is set to obsolete very soon. Of course, the contactless payment solution mentioned won’t suffer from this.

“process credit or d”

I don’t think it’s that kind of reader.