Micro investments platform, Acorns is now live in Australia, with the app now freely available to download and new users signing up to the service.

Acorns is a US-based company who has partnered up with local company Instreet Investment for their local launch here, and will be concentrating on the local Australian market. The concept behind Acorns is simple, once you link your bank account to your Acorns account, an app on your phone tracks your spending and simply rounds up your spending to the nearest whole dollar amount. When that total reaches $5 it withdraws the money from your account and puts it into your investment account.

There’s various levels of risk you can pre-set for the investment side of things, anywhere from conservative to really aggressive – this is investing after all, so there’s risks involved.

The app started beta testing a couple of weeks back, and is now open more widely with anyone able to sign-up to the service. There are some residual issues with the app, with some banks not yet working with the service. Listed on their Beta page, the company lists several banks with issues linking as ‘Roundup Accounts’, this includes any which require an additional SMS or email code to sign in (those don’t work at all) including:

- Suncorp

- St George

- Coles MasterCard

- HSBC Credit Card

- 28 Degrees MasterCard

- Big Sky Credit Card

- Greater Building Society

- GE Creditline

- CUA Mastercard – links but takes approx 15 minutes

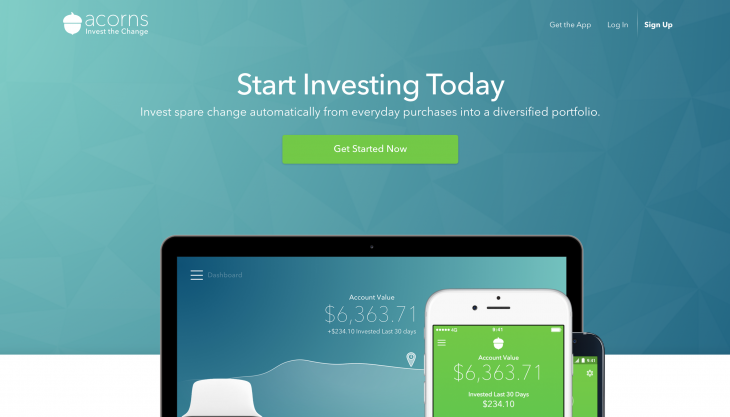

The app is pretty good to look at, but we expected that given that the service is based on a US one which has had an Android app for a fair while now. The app even has a handy widget for you to keep an eye on your investment status at a glance.

The app is now available in Google Play and you can sign up and add your bank account to get going right now. It’s worth checking out, unless of course you’re waiting for the Australian version, called ‘First Step’ to launch.

I wish Australian banks world start supporting modern ways of delegating access to accounts. Handing over login details is a ridiculously bad security practice. Using something like OAuth2 (out a custom auth framework) and per app permissions and limits isn’t rocket science, and world be a massive improvement over the status quo.

I’ve not used things like this before. Do people have thoughts on handing over banking info to a third party like this?

I agree. I would be really nervous giving a company I’ve never heard of access to my bank details which allows them to automatically withdraw money. It sounds like a recipe for disaster. Might be interested if it was a large household name financial institution, but I’ve never heard of these guys.

They’ve been around in the US for 1.5yrs. I’ve been using this app for 1 week (i.e. as soon as it has officially launched). This is better than throwing my spare change in a bucket sitting at home not earning interest. The app teaches you about long term investment. I so far have $37 in it. It’s liked to my CBA. In 1 week of use, I’m up by about 5 cents on ‘Moderately Aggressive’ strategy. No probs with the app so far. I’m looking forward for the RobinHood app to arrive in Australia. It has the same concept as… Read more »

I think i need to do some googling on the US version to see how to make this work as an investment strategy. I’m curious to know what the fees are like.

Fees are in the PDS ($1.50/month below $5k balance I think).

yes they are, well spotted

Hmm I seem to be having issues attempting to link up my NAB account, might try again later and see if it’s been resolved.