After launching the service launched in May, with iOS users able to insure their items right away, Android users are now able to insure the items in their treasure ‘Trov’ from today.

Trov is an asset management tool, letting you list all the items you currently own. Trov lets you add items you own, or are purchasing, storing details like a photograph of the receipt and a description of the item. It’s not just for the ephemera you keep in your home, but your larger assets like your home itself and your car , which you can have valued by Core Logic, and your Vehicle with a valuation supplied by Glass’s Guide.

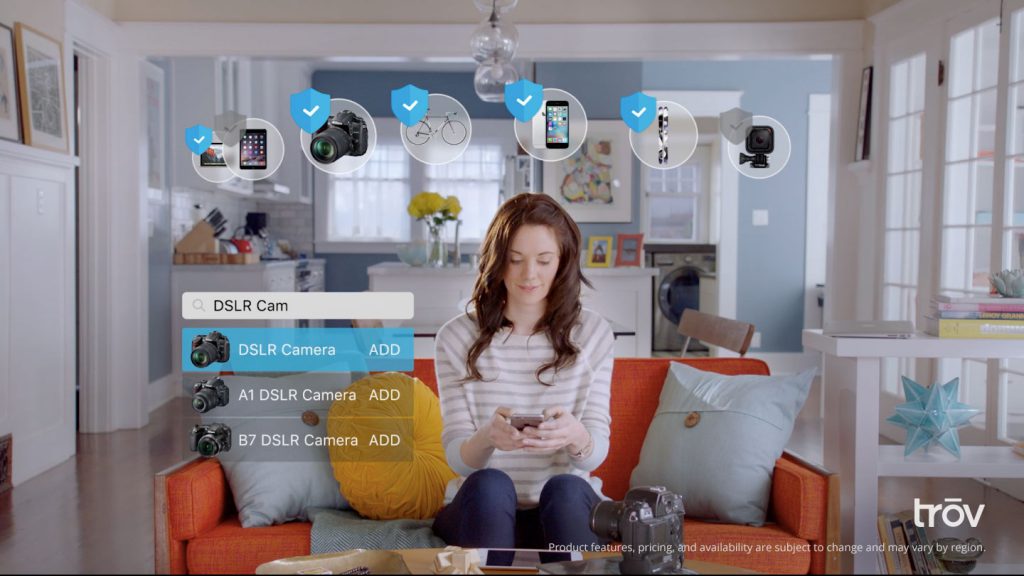

The focus for Trov though is insurance, they call it ‘On demand insurance’ for all your things. All the individual items you add to your Trov, including the house and car can be insured in Trov. The insurance component in Australia is being underwritten by Suncorp Australia. Trov essentially ensures that your DSLR, mountain bike or expensive tablet is covered against damage, loss or theft. Their PR says, simply catalogue your stuff, then it’s a matter of swipe to protect, offering you insurance for that item from cents per day.

Trov Founder and CEO Scott Walchek said

Since launch, phones and laptops are the most popular items we’ve seen protected with on-demand insurance. We’re proud to extend our offering to Android users and to continue to empower the mobile generation to take control of how they protect the things that are important to them.

You’ll need an account to use Trov – Facebook, or you can of course login with an email address – once you’re setup you can start adding in your possessions.

The app itself is pretty well laid out, there’s a slide out Nav drawer for all your settings, profile etc. and a floating action button to start adding in your possessions.

You’ll want to setup your details including your birth date – Trov offers insurance products and you have to be over the age of 18 to obtain them – as well as sex, employment status and of course your full name. You’ll also need to confirm your residence – if you’ve entered your home details as an item this is automatically populated.

Once you’re setup and added all your items, you’re good to go. Hit ‘Protect It’ on the item you want to insure and you’ll receive quote back – well, that’s the theory.

I had multiple failures trying to protect the phones in my Nexus collection – Nexus 6P, Nexus 5X etc. – which I found hard to believe because they were in their own database. I also had problems even finding the Nexus Q – but with that one such a rarity I can’t blame them. It did find my 2015 Macbook Pro, and offered me insurance on it at 56c per day, or $16.80 for the month.

If you want to go ahead with the insurance, you’ll need to choose your level of excess, then enter in credit card details to go forward.

The ‘on-demand’ aspect of Trov is very interesting, but it’s worth reading through the full Product Disclosure Statement (PDS) before moving ahead with any insurance purchase. It says Loss, Damage, Theft etc. but a number of Australians are wary of insurance companies, so forewarned is forearmed.

If you want to check out Trov, it’s available to download now from Google Play and start adding your stuff to, you can try out the insurance aspect if you want, or just use it to keep a running list of stuff you have.

On the face of it I have one initial concern. It sounds a bit like a variant of microtransactions. Everything looks cheap individually but I’m worried that individually covering all your stuff like this could quickly add up to a hideous figure.

Absolutely. I see it having it’s uses though. For short term use I think it’s a fantastic idea and would be ideal for holidays. Whether the actual rates are competitive who knows and I don’t think most people would care as long as they are using it in this manner. I can see problems with people who don’t understand what they are signing up for paying way too much though.. and a PDS isn’t going to necessarily help or educate all of these people. Putting it in a phone app and charging per day makes it so accessible which could… Read more »

Good points. A potentially great service for specific uses as long as you’re going in with your eyes open.